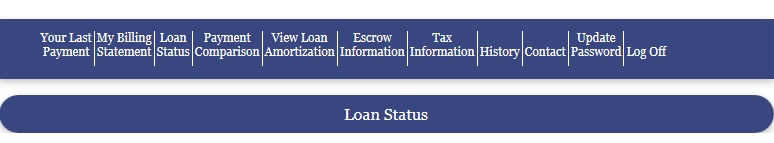

A Message for Current Customers:

The West Virginia Housing Development Fund is excited to announce a new line up of interactive tools for our current customers. After logging in, customers can make a payment and access new features. They can now:

- Lookup loan history

- View previous payments

- Retrieve year-end tax information

- View a personalized loan amortization

- Update contact information

- Review Monthly Billing statements

- Check Account balance and due dates

“Customers have been able to pay their... Continue Reading