Our Customer Service Staff is available during regular business hours of Monday-Friday, 8:30am – 4:30pm by calling 800-933-1272 or 304-391-8700 or emailing

eStatus Connect Multifactor Authentication

On June 7, 2023, eStatus Connect will implement a Multifactor Authentication Login Token Feature when logging into an account. Multifactor Authentication is a way to further validate the user logging into a web application.

You will be prompted to enter the “Login Token” that is sent to the email address that was entered on the Registration Page when registering your account. This token will expire 30 minutes from the time it was generated. You will be able to highlight, copy and paste the Login Token into the login page.

Returned Check Fee

Returned Check Fee: $15 (Effective May 1, 2025)

Frequently Asked Questions

If I have a large escrow shortage, do I have any options if I am unable to make the larger

payment? Yes. You may pay the escrow shortage in full with one lump sum payment or we can spread the shortage over a 12-month period. This should be mailed to:

WVHDF

5710 MacCorkle Avenue SE

Charleston, WV 25304

and identify it as a shortage payment. Please note: Paying the shortage will not keep the monthly payment from changing. The taxes or insurance divided by 12 will still need to be collected on a monthly basis.

Can I pay my own taxes and insurance? Collecting for taxes and insurance in your monthly payment creates an escrow account. This is established at the closing of the loan and will remain for the term of the loan.

Why did I receive an overage check? An overage check can be a result of your insurance premiums and/or taxes being less than we expected to pay. Your escrow analysis statement will show how the overage was calculated. Federal law requires us to return any surplus more than $50 to you.

Can I return my overage check and deposit it back into my escrow account? Yes, please return the overage check to us with specific instructions on how you wish the funds to be applied. This should be mailed to:

WVHDF Loan Servicing

5710 MacCorkle Avenue SE

Charleston, WV 25304

Why did I receive a check from an overage in my escrow account and then my monthly payment increased? Your annual escrow disbursements are projected by using your previous year’s actual escrow disbursements. Your estimated disbursements are deducted from your projected escrow balance. If your projected escrow overage is greater than $50.00, Federal law requires us to refund the overage. If your insurance premium or taxes increase during this 12-month period, it will cause an increase in your monthly payment for the next year.

Why did my payment increase? Your monthly payment will increase or decrease with any change to your taxes and/or insurance. Your taxing authority and insurance company/agent may adjust their billing, which ultimately will affect your monthly payment. You may wish to contact your local taxing authority or insurance company/agent for details concerning changes to your annual bills.

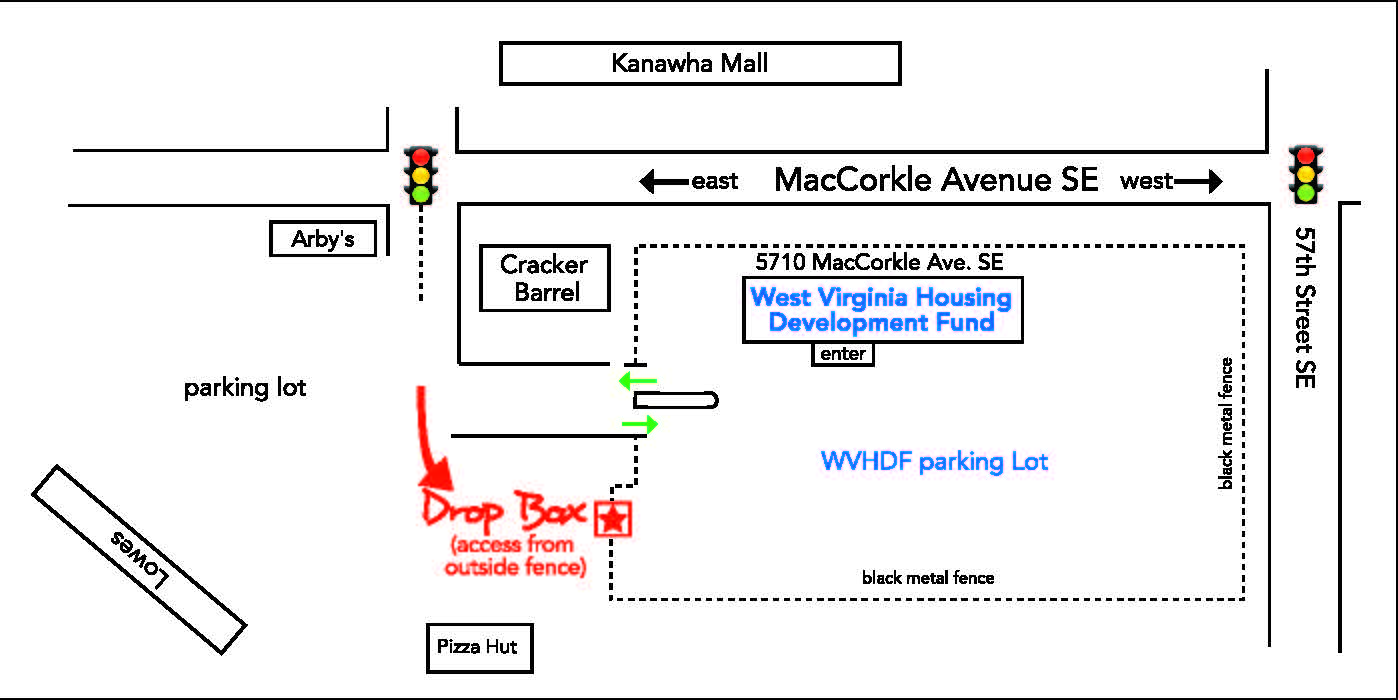

Drop Box Location

The West Virginia Housing Development Fund has a drop box for payments located outside our office at 5710 MacCorkle Avenue SE, Charleston, WV, 25304.